In the space of just a few years, the act of shopping in Dubai has been reimagined. The transition from crowded malls to seamless online checkouts accelerated dramatically during the global pandemic and has solidified into a permanent shift in consumer behavior. This transformation is not accidental but the result of a powerful convergence: a visionary government building world-class digital infrastructure, a young and affluent population with a natural affinity for technology, and global investors recognizing unparalleled opportunity

.

Today, Dubai stands as the undisputed ecommerce leader of the Arab world

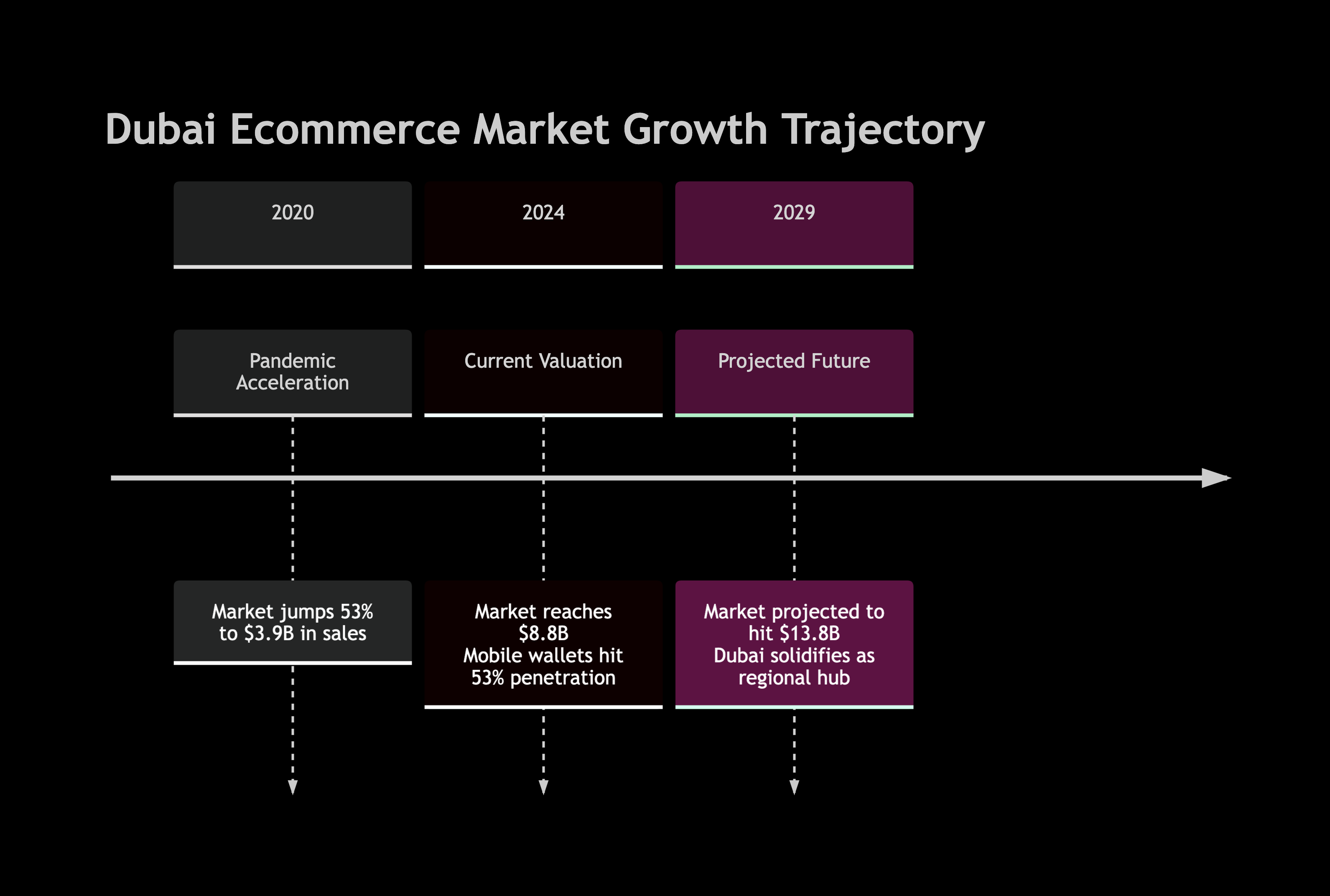

. With a market valued at AED 32.3 billion (USD $8.8 billion) in 2024 and projected to reach

AED 50.6 billion (USD $13.8 billion) by 2029

, the growth trajectory is both steep and sustained

. This article provides a comprehensive guide to understanding this dynamic landscape, the forces shaping it, and the actionable strategies for businesses ready to claim their stake in one of the world's most exciting digital markets.

Dubai's Ecommerce Market at a Glance

To grasp the scale and speed of Dubai's ecommerce evolution, it's essential to examine the key figures, drivers, and regulatory environment that underpin its growth.

Market Size and Growth Trajectory

The numbers tell a compelling story of rapid and sustained expansion. While different reports vary slightly in their exact figures due to methodology, they agree unanimously on the strong upward trend. The market jumped by an extraordinary 53% in 2020, reaching a record $3.9 billion in sales as consumers shifted online en masse

. This was not a temporary spike but a fundamental reset in habits.

Looking ahead, the most cited projection comes from Dubai's own "E-Commerce Report in the MENA Region 2024," published by Invest in Dubai, which forecasts growth to $13.8 billion by 2029

. This growth is part of a larger regional wave, with the broader MENA ecommerce market expected to swell from $34.5 billion to $57.8 billion over the same period, with Dubai at its operational and innovative core.

Key Growth Drivers

Several interconnected factors are fueling this exceptional growth:

Unmatched Digital & Physical Infrastructure: The UAE boasts one of the world's fastest internet penetration rates and highest smartphone adoption levels

- . This is complemented by the EZDubai free zone, a 920,000-square-meter logistics hub positioned between Al Maktoum International Airport and Jebel Ali Port, enabling same-day and next-day delivery across the GCC

.

Progressive Government Policy: Initiatives like the UAE Digital Economy Strategy and the mandatory federal "UAE Pass" digital identity have created a secure, streamlined environment for digital business

- . The UAE Pass alone has reduced customer acquisition costs by up to 35% for some platforms by simplifying identity verification

.

Evolving Consumer Payments: The shift from cash-on-delivery is profound. Digital wallet penetration rose from 41% in 2020 to 53% in 2024

- , while Buy Now, Pay Later (BNPL) services like Tabby and Tamara have become widely adopted, especially among younger shoppers, boosting conversion rates and average order values

.

High Disposable Income: A wealthy, cosmopolitan population with an appetite for luxury and convenience continues to drive premium online purchases

.

Understanding the Dubai Online Shopper

Success in Dubai's market requires a nuanced understanding of its diverse and sophisticated consumer base.

Demographic and Behavioral Profile

The typical online shopper in Dubai is young, tech-savvy, and has high expectations. Over 75% of all purchases are completed on smartphones, making a mobile-first strategy non-negotiable

- . These consumers are not just buying necessities; they are purchasing across a wide spectrum, with fashion (apparel and accessories) holding a 22% market share as the largest single category, followed closely by consumer electronics and beauty & personal care

.

Trust and security are paramount. Influenced by social media reviews and recommendations, shoppers demand seamless, secure transactions. Notably, a significant portion of purchases (historically as high as 58%) are cross-border, made from international vendors trusted for brand authenticity and reliable shipping

.

Key Consumer Expectations

Dubai's shoppers have been conditioned by world-class service standards. Their key expectations include:

Speed & Convenience: Free same-day or next-day delivery is becoming the norm in urban centers

. A smooth checkout with minimal steps and multiple payment options is essential.

Personalization: Consumers respond to curated experiences, AI-driven recommendations, and communication that reflects their purchase history and preferences

.

Seamless Omnichannel Experience: The lines between online and offline are blurred. Services like click-and-collect (Buy Online, Pick Up In-Store), real-time inventory visibility, and unified customer service across channels are powerful differentiators

.

Authenticity & Sustainability: There is a growing consciousness around brand ethics and sustainability. Clear communication about sourcing, eco-friendly packaging, and ethical practices can build strong loyalty

.

Logistics, Payments, and the Operational Backbone

The customer-facing magic of ecommerce is made possible by robust operational systems. Dubai excels in this regard, though challenges remain.

The Logistics and Fulfillment Advantage

Dubai's geographical position as a global crossroads is a natural advantage, amplified by intentional investment. The EZDubai free zone provides a plug-and-play ecosystem for ecommerce businesses, offering streamlined customs, integrated logistics services, and proximity to major air and sea ports

- . This infrastructure supports the intense demand for fast delivery, with same-day coverage available for over 90% of Dubai's urban population

.

However, the "last-mile" to the customer's door remains a complex and costly piece of the puzzle, especially in less dense areas. Companies are innovating with micro-fulfillment centers, dynamic routing algorithms, and partnerships with specialized last-mile providers to balance speed with profitability

.

The Digital Payments Revolution

The shift in how consumers pay is revolutionizing the economics of ecommerce.

Decline of Cash on Delivery (COD): While COD was once king, its use is shrinking in favor of digital prepayments, which improve cash flow and reduce the cost and complexity of failed deliveries for merchants

.

Rise of Digital Wallets & BNPL: As noted, digital wallets are now used in over half of all online transactions

- . BNPL services have also exploded in popularity by offering flexibility and aligning with Sharia-compliant financial principles, encouraging higher cart values.

Quick Commerce vs. Standard Ecommerce

| Feature | Quick Commerce (Q-commerce) | Standard Ecommerce |

|---|---|---|

| Delivery Promise | Minutes to a few hours (e.g., 30-min) | Next-day or 2-3 days |

| Core Offering | Essential, high-demand items (food, groceries) | Vast assortment across all categories |

| Business Model | Hyper-local dark stores, high operational intensity | Regional fulfillment centers, optimized inventory |

| Key Challenge | Intense price wars & high last-mile costs |

| Balancing vast inventory with efficient logistics |

Strategic Opportunities for Businesses

For entrepreneurs and established brands, Dubai presents a fertile ground for growth, provided they approach the market strategically.

High-Opportunity Sectors

Beyond the dominant fashion and electronics categories, several sectors show exceptional promise:

Beauty & Personal Care: This is a high-growth vertical, with sales potential scaling from $200 million to $1 billion by 2025, driven by affluent shoppers seeking premium and curated products

.

B2B Ecommerce: While B2C captures headlines, the B2B segment is forecast to grow at a remarkable 19.5% annually

. Platforms digitizing procurement for businesses offer significant value through higher order values and embedded services like trade finance.

Sustainable and Niche Products: As consumer awareness grows, brands with a clear commitment to sustainability, ethical sourcing, or those catering to specific hobbyist communities can carve out loyal followings

.

Essential Market Entry and Growth Strategies

Leverage Marketplaces Initially: Platforms like Amazon.ae, Noon, and regional specialist Namshi provide instant access to a massive, trusted customer base and handle key logistics

. This is an effective, lower-risk way to test the market.

Invest in Localization: This goes beyond translating your website into Arabic. It involves tailoring your product assortment, marketing messaging, and promotions to align with local culture, holidays (like Ramadan and Eid), and consumer preferences in Dubai versus other emirates

.

Master Social Commerce: Social media is not just for branding; it's a direct sales channel. Platforms like Instagram Shopping and TikTok Shop are integral to the customer journey, especially for reaching Gen Z and Millennial audiences

. Integrating these "shop-able" experiences is critical.

Prioritize Customer Experience (CX): In a competitive market, CX is the ultimate differentiator. Invest in a user-friendly website, responsive multilingual customer support (consider 24/7 live chat), and a hassle-free returns policy to build trust and encourage repeat business

.

Challenges and the Road Ahead

The path is not without its hurdles. Businesses must navigate margin pressures from intense competition and quick-commerce price wars

- . High customer acquisition costs and the complexities of last-mile delivery in a region without a unified address system are ongoing operational challenges. Furthermore, compliance with the UAE's Personal Data Protection Law adds a layer of regulatory consideration, especially for international firms

.

Despite these challenges, the future is bright. Trends like deeper AI integration for hyper-personalization, the growth of social search (where consumers use TikTok or Instagram instead of Google to find products)

- , and a continued push toward faster and greener logistics will define the next phase of growth

.

Conclusion: Your Invitation to the Future of Retail

Dubai's ecommerce story is still being written, but the theme is clear: immense, innovation-driven growth powered by a perfect alignment of policy, infrastructure, and consumer readiness. The market's projected rise to a $13.8 billion powerhouse by 2029 is an open invitation to agile, customer-centric businesses

.

The key to success lies in respecting the sophistication of the Dubai consumer—meeting their demands for speed, convenience, and authenticity—while leveraging the world-class tools and infrastructure the emirate provides. Whether you are a global brand, a regional challenger, or a startup with a novel idea, there has never been a better time to engage with the digital heartbeat of the Middle East. The opportunity is not merely to sell online but to become a part of the ecosystem that is reshaping how a region shops.

Sources:

- Brightery.com

- Statista

- Several

{{comments.length}} Comments

{{comment.name}} · {{comment.created}}

{{sc.name}} · {{sc.created}}

Post your comment